Bloomberg Beats Reuters, FactSet: William Blair Survey

The survey findings were presented in a report titled “Financial Information Services: Conclusions From Survey of End-Users,” authored by William Blair analysts Timothy McHugh, Stephen Sheldon and Matt Hill. The survey covered financial information systems provided by FactSet, Thomson Reuters Corporation (NYSE:TRI) (TSE:TRI) (TSE:TRI-B), Bloomberg and Capital IQ.

This article focuses on the survey findings related to the competitive strengths of Bloomberg and Thomson Reuters, the two larger providers.

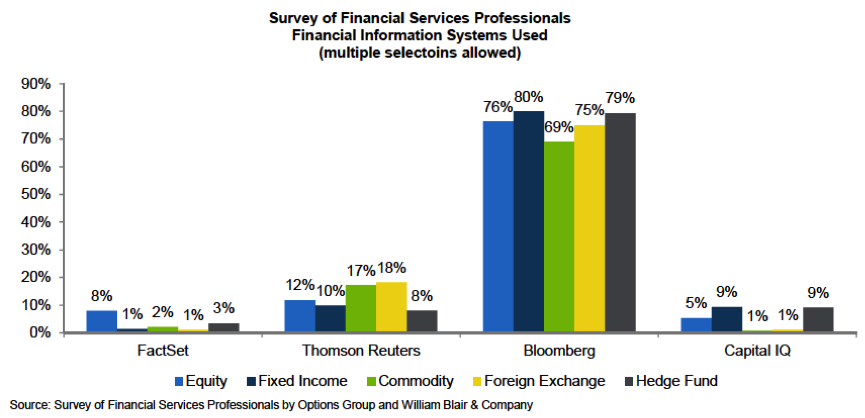

System usage by category of user

The survey received 1,900 responses from participants across different regions, position types and securities handled.

“About 6% of respondents indicated that they primarily use FactSet, about 6% of respondents indicated that they primarily use Capital IQ, about 14% of respondents indicated that they primarily use Thomson Reuters, and about 68% of survey participants said they primarily use Bloomberg,” say the analysts.

These results are shown in the above chart broken down by type of user, i.e., whether equity, fixed income, commodity, Forex or hedge fund. Note that respondents were allowed to select multiple systems in their responses.

Bloomberg is used nearly five times as often as its closest competitor Thomson Reuters. We note that Thomson Reuters had a high component of users in Forex and commodities. Fixed income and hedge funds were the largest users within Bloomberg.

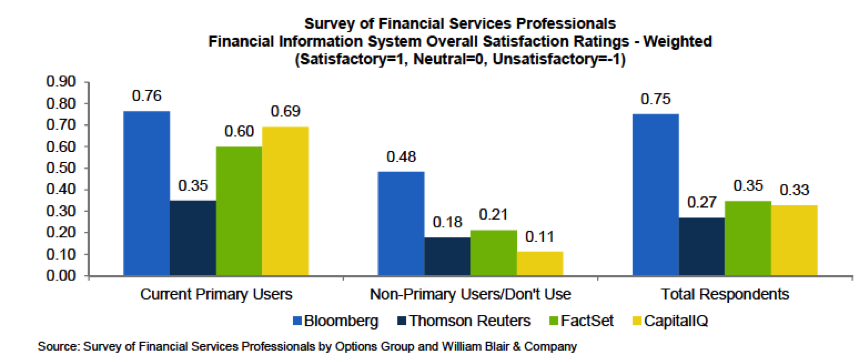

Satisfaction levels by type of user

Bloomberg (0.76) had the highest satisfaction levels, while Thomson Reuters (0.35) was at the bottom of the table. Capital IQ (0.69) and FactSet (0.60) scored over Reuters in terms of user satisfaction.

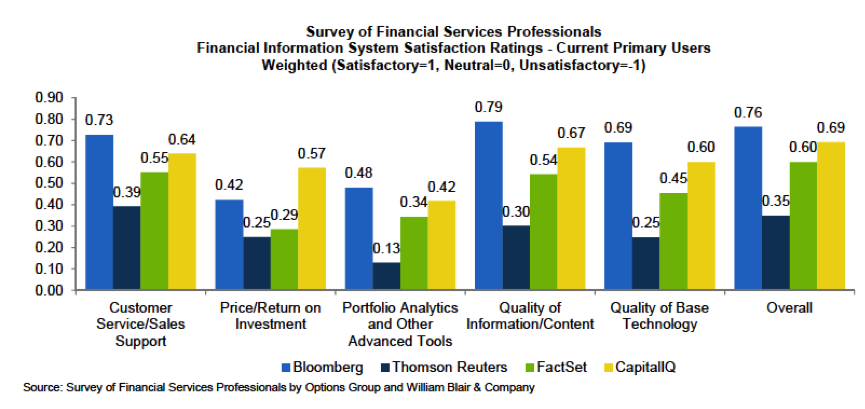

Satisfaction level by system component

Thomson Reuters Corporation (NYSE:TRI) (TSE:TRI) (TSE:TRI-B) trailed behind Bloomberg on every component, from customer service to ROI. Bloomberg led all the providers in all the components save Price/ROI, where Capital IQ stole the show. This is not surprising, considering Bloomberg charges about $25,000 annually per terminal – almost double of other providers.

“For Thomson Reuters Corporation (NYSE:TRI) (TSE:TRI) (TSE:TRI-B), responses were less positive than other providers across the various metrics. Thomson Reuters received the lowest rating on the price/return on investment and the portfolio analytics and other advanced tools. We have heard that Thomson Reuters has still been giving large discounts and concessions to some clients even though management said in March that it wants to hold pricing steadier in the future. Even with the pricing discounts and concessions, respondents who primarily use Thomson Reuters indicated a lower return on investment than other providers,” reveals the report.

Conclusion

According to the analysts, Thomson Reuters Corporation (NYSE:TRI) (TSE:TRI) (TSE:TRI-B) could lose market share to FactSet and Capital IQ given that, “Thomson Reuters ratings segment continues to have a fairly large business and its ratings were notably lower for current primary users than other providers.”

On the other hand, gaining significant market share from Bloomberg could be challenging given its very high satisfaction ratings in the survey.